How Jio Data Loan Operates

Jio Data Loan is a Jio Communications Limited (JCL) product that allows users to borrow up to Rs 2,500* per month against their data usage. The loan is payable in 8 monthly instalments, and the interest rate is currently fixed at 10%. Jio Data Loan can cover data usage, including streaming, gaming, downloading, etc. Jio Data Loan can also be a backup credit option in an emergency.

Jio Data Loan has been very popular since its launch last year and has already garnered the attention of many users. The main reason for this popularity is the low-interest rate (10%) coupled with the flexibility of repayment options. Moreover, this product has no hidden charges or late payments, making it very user-friendly.

What is the Jio Data Loan code? How does it work?

When getting a loan, many people turn to traditional lenders like banks. However, other options are also available, such as Jio Data Loan. This service is provided by Jio and allows customers to borrow money to cover short-term financial needs. The Code used for this service is JDL1.

The process of obtaining a Jio Data Loan is relatively simple:

- The customer must sign up for an account with the company. Once they have done this, they can see their current balance and outstanding loans.

- They must provide basic information about themselves, including their occupation and annual income.

- They must provide documentation proving their income and identity.

Once the necessary information has been collected, the customer can request a loan. The loan process is automated and will take just a few minutes to complete. Once the application has been approved, the customer will receive a notification in text and email. They can then access their loan funds immediately via their bank account or the Jio Money app.

Key Features: What are the benefits of using Jio Data Loan?

Jio Data Loan is a product by Jio that allows customers to borrow money against the data they have consumed. The customer can borrow up to Rs 2,500 monthly, and the interest rate is 18%.

The main benefits of using Jio Data Loan are convenience and security. Convenience comes in the form of no paperwork or any need for a credit score. Security comes from the fact that if you cannot repay your loan, Jio will immediately delete your data.

Jio data loan toll-free number

Jio data loan is a new service from Jio that allows customers to borrow up to Rs 1 lakh at low-interest rates. The service was launched in early August and has since become one of the most popular features on Jio.

How the Jio data loan works: Customers must apply online through the Jio app or website after registering for the service. They will then be asked to provide basic information, such as their name and phone number. After this, they will be given a loan amount and interest rate.

The loan can be used for various purposes, including paying off debts, buying new electronics, or covering unexpected expenses.

Customers have 60 days to repay the loan; if they fail, the money will automatically be transferred back to their account.

Jio data loan is an exciting new service that allows customers to access quick cash without worrying about high-interest rates or long waiting times. The service is easy to use and provides fast payments so users can get back on track quickly.

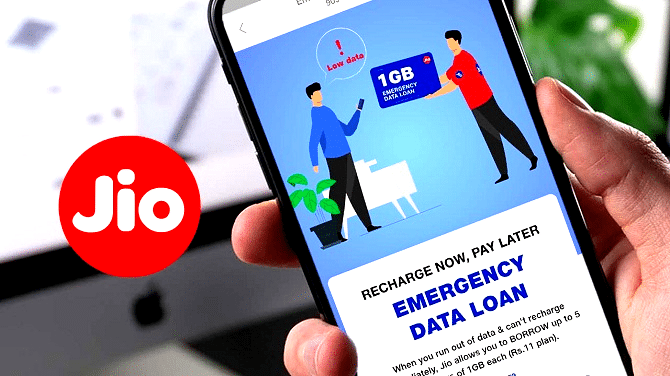

How can I get a 1 GB loan on Jio?

Jio Data Loan is a new product from Jio that allows users to borrow up to Rs 1GB of data for 28 days. The loan can download music, videos, and other content. The data can be used even on devices not subscribed to Jio services.

To avail of the loan, users must create an account on the Jio website. Once they have created an account, they must enter their mobile number and email address. Next, they will be asked to select a payment mode: cash or bank transfer. After selecting the payment mode, users will be given an estimate of how much data they will borrow and will be sent a confirmation email.

Once the user has received the confirmation email, they need to go through the process of borrowing data. To borrow data, they must first click on the link in the email and sign in using their credentials.

They will then be taken to a page where they can select how much data they want to borrow and pay for it. The total cost of borrowing data will be shown in both forms of currency (in USD and INR) and in terms of monthly repayments.

After selecting the repayment plan, users will be returned to the main page, where they can download content using their borrowed data.

How can I get loan on Jio for data?

Jio Data Loan is an innovative product from Jio. It allows individuals to borrow money against their data usage for various purposes such as online shopping, cash withdrawals, and more. The amount you can borrow depends on your data usage and the credit score of your lending institution.

The process of borrowing against your data is simple. You must create an account with Jio Data Loan and enter your details, such as name, address, and bank account number. After that, you must submit a loan application requiring you to provide information about your income, expenditure, and debts.

Once the application is processed, you will receive a loan offer in the form of a cheque or a debit card which you can either accept or decline. The whole process takes around four hours from start to finish.

Jio Data Loan is an innovative product that allows individuals to borrow money against their data usage for various purposes, such as online shopping, cash withdrawals, and more. The process is simple, and the loan amount depends on your data usage and the credit score of your lending institution.

FAQs

If you want to know how Jio Data Loan operates, here are some FAQs that may help.

How long does it take for my loan application to be processed?

It typically takes around 24 hours for your loan application to be processed once you have submitted it. In some cases, if there are additional questions or documents that need to be submitted, the processing time may extend a bit longer. However, we constantly endeavor to get your application processed as quickly as possible.

What is the APR for Jio Data Loan?

The APR for Jio Data Loan is now fixed at 9%. This rate is applicable until December 31st, 2020. After this date, the APR will increase by 0.5% every quarter and reach 12% by December 31st, 2021. Please note that this applies only to loans taken up after January 1st, 2019. If you have taken out a loan before this date and would like to know the current APR rate applicable to you, don’t hesitate to get in touch with our customer support team at: 1800-227-2223 or email us at customercare@jiodataloan.com

What are the terms of my loan?

Your loan term generally ranges from 7 days to 36 months. The terms of your loan can be extended if needed but only for an additional period of up to 6 months (i.e., the total amount borrowed cannot exceed 36 months).